4 min read

As we start the new year with a return to nationwide lockdown, we’re all hoping it’s the final addition to this particular trilogy.

The mortgage industry has seen immense change over the last 12 months and with the uncertainty prompted by the pandemic set to extend into 2021, we wanted to kick off the first of our webinars this year by addressing a topic that we’re seeing real demand for more information about: mortgages for the self-employed.

To source a wealth of insights and different perspectives on the issue, I was lucky enough to be joined by experts from across our industry: Nicola Firth from Knowledge Bank, Danny Belton from Legal & General and our very own New Business Director, Craig McKinlay.

Market Insight

| We know that mortgages for the self-employed are more relevant than ever: if you look back at 2001, 3.3 million people were self-employed. Fast-forward to 2020 and 5 million of us are self-employed. Yet whilst being self-employed has become part of the new normal, we know that these customers still struggle: 36% of self-employed individuals don’t bother submitting a mortgage application or a remortgage application in fear of it being rejected*. Pre-pandemic, things were improving when it came to securing mortgages if you were self-employed but sadly the challenges prompted by people’s changing financial circumstances have set this progress back. |

Impact of the pandemic

| We know the pandemic hasn’t helped things and research that both Danny and Nicola shared from Knowledge Bank and Legal & General demonstrated the increase in enquiries around self-employed mortgages, particularly as people came out of lockdown(s) and wanted to assess their options. Knowledge Bank recorded a 10-fold year-on-year increase in broker support enquiries relating to self-employed applicants. 2020 gave us time to reflect more on what we really want – especially when it comes to our living arrangements. We know that people are trying to find out more about the opportunities that are available to them. |

Evolving assessment criteria

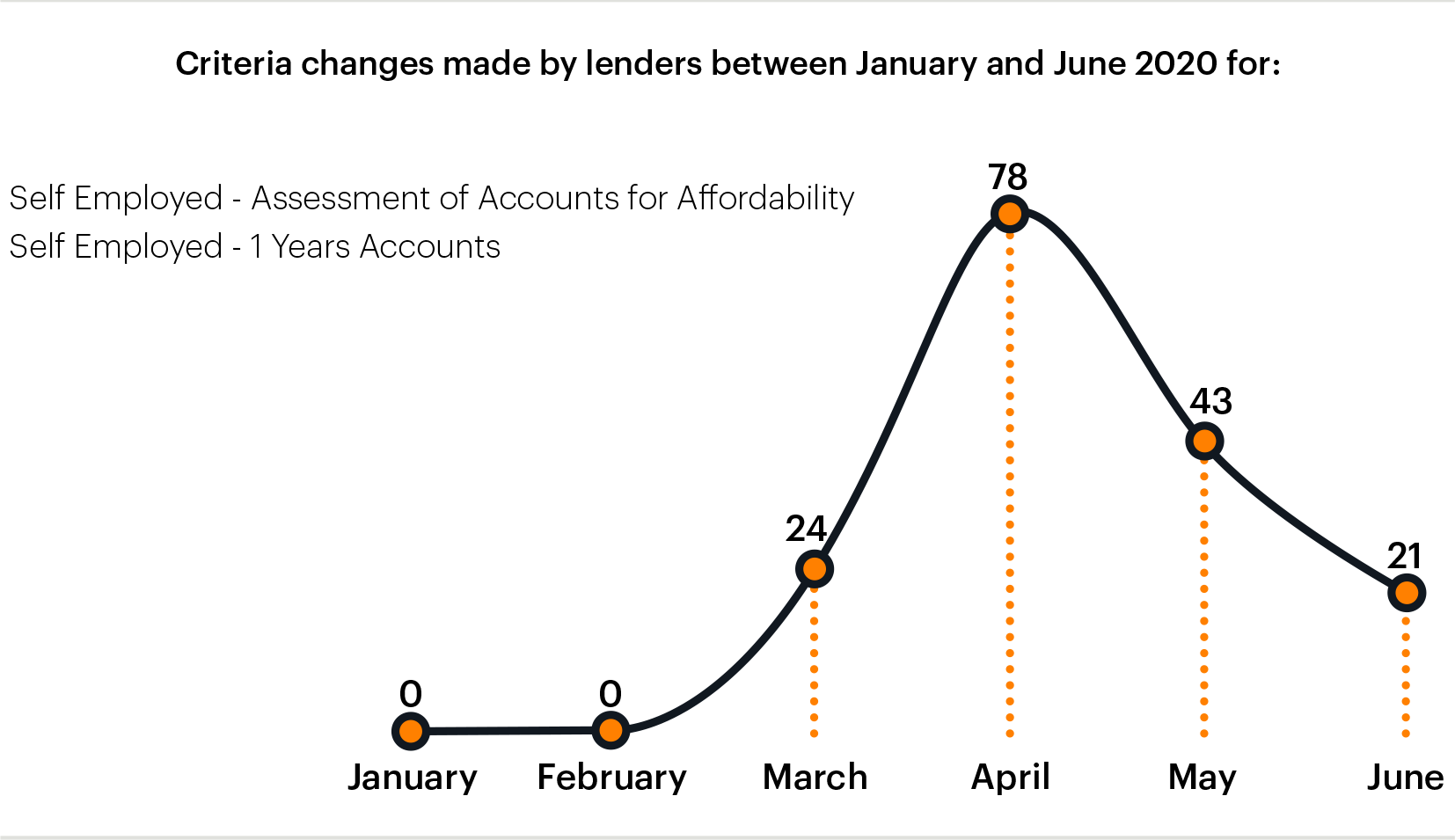

| As Craig pointed out, there are significant challenges that lenders need to confront when it comes to assessment criteria. Things simply aren’t clear cut: you can put customers in either the employed or self-employed box and label one as safe and the other as risky. In reality, whilst some self-employed people have been hard hit by the pandemic, many have managed to grow their business as a result: just consider the difference between the owner of a local bar versus someone running a PPE import business. Then consider how busy the owner of a hairdressing salon is right now versus the day lockdown ends and you begin to get a sense of the nuanced picture! Lenders have reacted to the changing market: Knowledge Bank data shows that criteria changes made by lenders between January and June 2020 (for assessments of accounts for affordability and one year’s accounts) shot up from February, peaked in April and then decreased for the remainder of the year. How lenders assess affordability and risk is a big point of contention and something that our panelists unanimously agreed needed reviewing in light of the implications of the lockdown on people’s financial records. |

|

The role of intermediaries

| With so much changing at such pace, it can feel hard to keep up. Many customers are apprehensive about their mortgageability and are uncertain about the impact of receiving bounce back loans, mortgage repayment holidays and the changes mandated by IR35. Intermediaries who help customers navigate their changing personal circumstances will be hugely valued. We must remember that some people have taken grants and payment holidays because they can – not because they necessarily needed it. |

My personal takeaway

| For me, the most interesting takeaway was the importance of looking at each mortgage on a case-by-case basis and the increasing significance of manual underwriting in the new world of mortgages that we’re set to enter into. Whilst tech has a role to play in improving the mortgage process by enabling us to access more datasets and review them more efficiently, manually underwritten lenders are in a far stronger position compared to their robo-advisor counterparts. Why? Because moving beyond box-ticking exercises to get an accurate, current picture of someone’s personal circumstances gives you a far better indication of risk at times of uncertainty. As Danny raised, the key is gaining a real insight into what’s going on and the viability of someone’s business, finding answers to the questions that matter. Are things sustainable? Can the business stand the test of time or is it just current circumstances that are causing pain points? In the world of business, we often get caught up in corporate structures and lose sight of the fact that we’re dealing with people and their lives. With greater complexity comes the need for reassurance and the team at Kensington Mortgages will continue to meet the needs of people the high street can’t always cater for. |

A look to the future

As we look ahead to the remainder of 2021 and beyond, Nicola made a poignant point: we’ve been here before! Post-credit crunch, self-employment figures shot up as people sought out new ways through which to secure income. We’re anticipating a similar trend post-Covid and the mortgage industry must be ready for the rise of the self-employed.

The changes in the marketplace present great opportunity across the industry and we are looking forward to working with customers and intermediaries to secure the outcomes that so many self-employed people deserve as we move forward into a new era of mortgages.

Frances joined Kensington Mortgages in January 2019 as Head of National Accounts, with responsibility for building the National Accounts strategy and managing key intermediary partner relationships, as well as leading a new team. With over 15 years’ experience in financial services, working for Chelsea Building Society, Countrywide PLC and Principality, Frances has a wealth of industry knowledge.