13 November 2019

A beginner’s guide: The Monetary Policy Committee – how does it affect you?

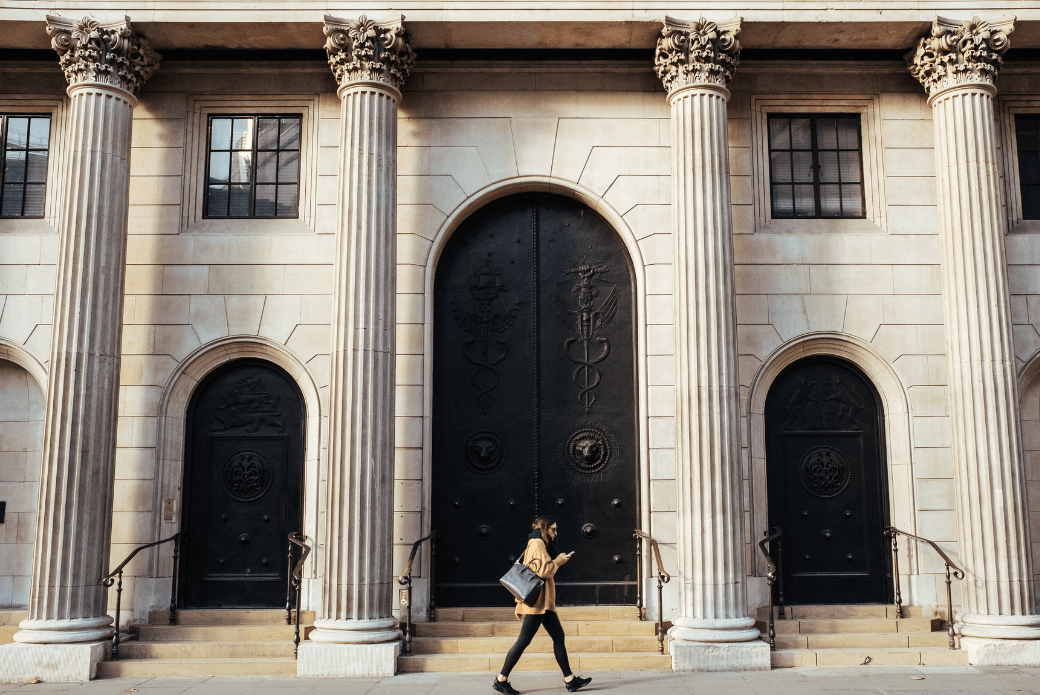

Every month, the Bank of England Monetary Policy Committee (MPC) meets to make one of the most important decisions in running the UK economy – deciding the UK’s bank base rate.

While there is always a media buzz around whether the rate will stay the same, decrease, or increase, it can be confusing amongst this noise to understand how this decision impacts your daily life – and what the decision actually means. In my latest blog, we’ll take it back to basics, looking at the importance of the MPC, the base rate, and what factors influence the MPC’s decision.

What is the MPC?

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which usually meets eight times a year to decide the official Bank of England Base Rate. The Committee was formed in 1997 and designed to be independent of political interference. Subject to popular belief, the Government has no say in what the MPC decides in these meetings.

As a group, they are responsible for keeping the Consumer Price Index (CPI) measure of inflation close to a target set at 2% per year. While a variety of economic measures impact CPI inflation – the basic rule of thumb is - if inflation decreases, the MPC is more likely to increase the base rate. If inflation increases, they are more likely to cut the base rate.

A higher base rate means it costs more for banks, businesses and individuals (like homeowners) to borrow money. Higher interest rates mean higher borrowing costs, which in turn discourage people from spending more. With less spending, the economy slows, and inflation decreases.

On the other hand, if inflation increases, the MPC will consider decreasing the base rate. Cheaper rates will encourage individuals to spend and borrow more money.

It’s a supply and demand effect.

Who’s in it?

The MPC is made up of nine members, including Mark Carney, who’s been the Governor of the Bank of England since 2013. However, his term ends in January next year, so we are awaiting the announcement of his replacement. Each member of the MPC has expertise in the field of economics and monetary policy. Members do not represent individual groups or areas – they are independent.

What was the decision of the last meeting?

On 18th September, the MPC voted unanimously to keep the Bank Rate on hold at 0.75% - where it’s been since August 2018. Before this, the rate has been 0.5% since November 2017.

The lowest base rate we’ve ever seen - 0.25% - happened straight after the EU referendum in 2016. Previously though, it had been back at 0.5% for over a decade.

The current rate is still one of the lowest though - in the 1980s and 90s, rates were near double digits. October 1981 saw the rate at its highest ever point of 15%.

Why did they decide this?

The MPC’s decision to hold rates at 0.75% was in line with what the market expected, as the economy has been volatile due to Brexit-related developments.

We’ve looked at how CPI inflation is one of the main factors of determining the base rate. CPI inflation fell to 1.7% in August, down from 2.1% in July. The MPC expects it to remain slightly below the 2% target for the short term, before rising close to the 2% target at the beginning of 2020. In addition, the minutes highlighted that the more prolonged the uncertainty, the more inflation might weaken. So – the sooner we have a decision on Brexit, the better!

However, UK gross domestic product (GDP) and unemployment figures are also significant considerations in the decision-making process.

Starting with GDP – it fell by 0.2% in Q2 2019, 0.2% weaker than expected. The markets believed this could have been due to lower than anticipated GDP growth from vehicle manufactures. To boost the economy, the government announced a significant increase in spending which could raise GDP by 0.4% over the next few years.

On the jobs front, the market remains healthy, with unemployment levels at 3.8% in the three months to July, just 0.1% higher than expected in August’s Report. An increase in full-time employment mainly drove this. Annual pay growth also increased to its highest rate in over a decade.

Are there any other factors that the MPC considers?

As if there weren’t enough, yes. Household consumption, house prices, and consumer confidence are considered.

Household consumption strengthened following a growth of 0.5% in Q1, rising by 0.5% in Q2, which was stronger than expected. Unsurprisingly, consumer confidence dipped in August. Despite house prices remaining flat, mortgage approvals continued to edge up as first-time buyers look to make the most of stagnant price growth.

The B-word

There’s no doubt that Brexit uncertainty has weighed on business investment, which has declined in five of the past six quarters.

While a Brexit deal has been agreed in principle with the EU – both the UK and EU need to approve and sign the withdrawal agreement. Given the roiling waters of British politics, a no deal scenario cannot yet be ruled out entirely.

The MPC highlighted that in a no deal scenario, the exchange rate will probably fall. This would lead to a rise in CPI inflation and a slowdown in GDP growth. In this case, MPC commented that any future interest rate decision would not be automatic and could be in either direction.

So, what comes next?

Following the meeting, the markets then use the rate decision as an input as well as other market indices such as swap rates (the rates at which banks borrow between one another and influences the price of fixed rate mortgages) to plan accordingly.

In light of these considerations, there has been some talk that the base rate might be cut to 0.5% in the next six months.

In terms of swap rates, the market is predicting two-year interest rates will drop to 0.5 % within the next year before rising to 0.75% in two years time. Meanwhile, five-year swap rates are now expected to remain around 0.75% for the next three years. The 10-year swap rates are still likely to stay at 0.75% for the next three years.

Hopefully this blog has proved useful. It was a little different to my usual ones, so if you enjoyed this and would like to see more of this – please feel free to email me at vicki.blog@kensingtonmortgages.co.uk

Vicki Harris has 20 years of experience working in challenger financial services brands, working across asset management, banking and specialist lending. She is Chief Commercial Officer of Kensington Mortgages, the UK’s leading non-bank specialist mortgage lender.