Vulnerable customers

Identifying vulnerable customers and capturing vulnerability information in our broker portal.

The detail

The FCA has updated its guidance on identifying vulnerable customers to help companies ensure that they have the right processes in place to identify vulnerabilities, understand them and be able to offer the right services to help their customers.

Who are vulnerable customers

Traditionally, a customer’s vulnerability may have been determined by whether they were experiencing financial difficulties which made it difficult for them to pay their mortgage and other financial commitments. Today, vulnerability covers so much more and encompasses a wide range of circumstances which can be singular or multi-layered. The list below will help you to identify the different types of vulnerability when talking to your clients.

-

This can be any kind of health condition that may affect the applicant's ability to carry out day to day activities. For example:

- A physical disability

- Critical, severe, or long-term illness

- Hearing or visual impairment

- Mental wellbeing

- Memory or learning impairments

-

There are often additional pressures associated with many life events that can affect how the applicant manages their finances. Or maybe a change in situation means that they must take over the finances when someone else previously in their household managed them on their behalf. For example:

- In the event of a bereavement

- The breakdown of a relationship

- Planning for, or entering retirement

- Experiencing domestic or financial abuse

- A change in income that was unexpected (including economic control)

- Caring responsibilities

-

Defined as someone who may have little knowledge of financial matters or low confidence in being able to manage money. This could be due to having lower capability in things like literacy or digital skills, or not having someone who does have these skills to help or support them. Characteristics can include:

- Lacks confidence in managing finances

- Poor literacy or numeracy skills (eg. takes slightly longer to read, absorb and process information)

- Poor English language skills (eg. English as a second language)

- Poor or non-existent digital skills

- No or low access to help or support

-

Many households have limited savings to fall back on in emergencies or rely on all their monthly income to cover planned expenses, leaving little room for unexpected or increased costs. This can mean household finances are more at risk from changes in income, costs to run the home, or emotional shock often experienced with a life changing event.

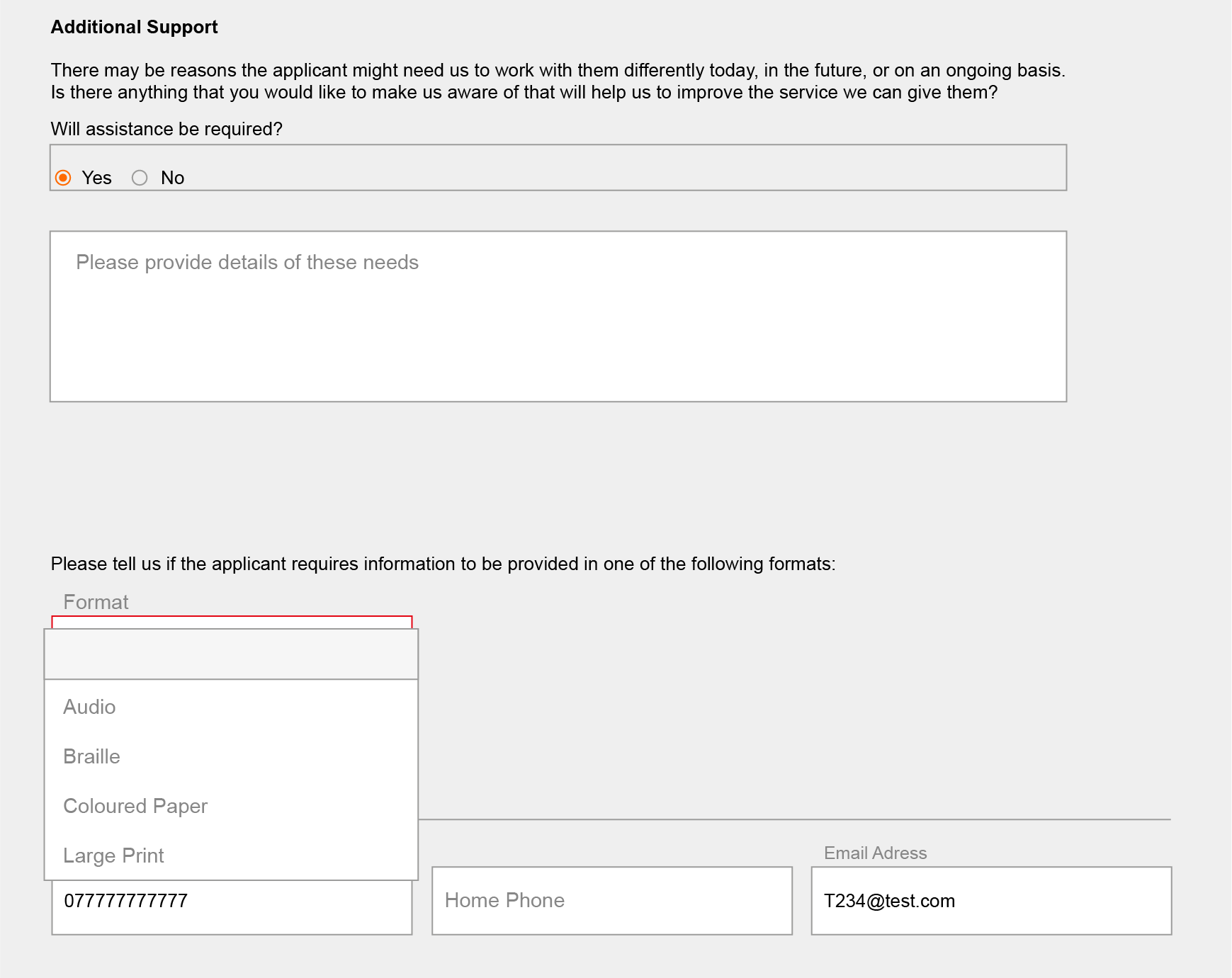

Capturing vulnerability information in our broker portal

As part of the information we collect for mortgage applications within our broker portal, you will now see a specific question relating to any vulnerabilities your clients may be experiencing. You will simply need to input the information in the relevant areas so that we have a record and can provide the right support if they contact us about their mortgage account once they become a Kensington customer. As guidance, we have included an image of what the new vulnerability section will look like below.

We’re here to help

If you have any questions, please contact your local BDM who will be happy to help you